XRP Price Prediction: Technical Consolidation Meets Fundamental Crosscurrents

#XRP

- Technical Consolidation: XRP is trading near its 20-day moving average with narrowing Bollinger Bands, suggesting potential for a significant price movement in either direction

- Mixed Fundamentals: Positive network growth (7M+ active accounts) contrasts with supply concerns and ETF performance divergence

- Institutional Focus: Former Ripple executives emphasize institutional adoption over retail trading, potentially supporting long-term value

XRP Price Prediction

Technical Analysis: XRP Shows Mixed Signals Near Key Moving Average

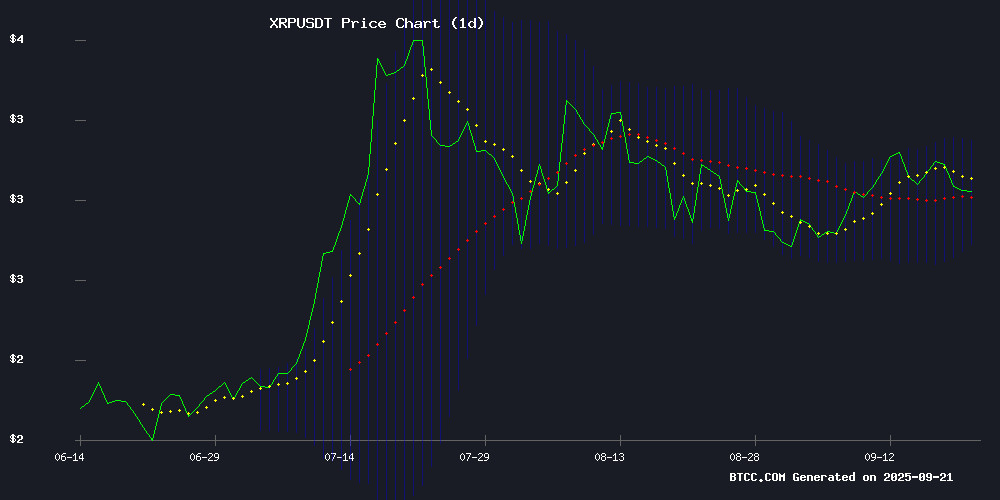

XRP is currently trading at $2.9809, slightly above its 20-day moving average of $2.9667, indicating potential short-term stability. The MACD reading of -0.1289 suggests ongoing bearish momentum, though the narrowing histogram at -0.0454 points to decreasing selling pressure. Bollinger Bands show price action NEAR the middle band with upper resistance at $3.1644 and lower support at $2.7689, creating a relatively tight trading range.

According to BTCC financial analyst Ava, 'XRP is testing crucial technical levels. The proximity to the 20-day MA and narrowing Bollinger Bands suggest consolidation before the next significant move. Traders should watch for a break above $3.16 or below $2.77 for directional clarity.'

Market Sentiment: Mixed Fundamentals Amid Institutional Focus

Recent developments present a complex picture for XRP. The plummeting burn rate raises supply concerns while the milestone of 7 million active accounts demonstrates growing network adoption. The institutional focus highlighted by former Ripple executives contrasts with the divergence between ETF volume and market performance, creating uncertainty among investors.

BTCC financial analyst Ava notes, 'The fundamental landscape is contradictory. While institutional adoption signals long-term strength, the supply concerns and ETF performance divergence cannot be ignored. The market appears to be weighing these competing factors, leading to current price struggles.'

Factors Influencing XRP's Price

XRP Burn Rate Plummets Amid Supply Concerns and Price Struggles

XRP's token burn mechanism has nearly ground to a halt, with only 163 tokens burned on September 21—a dramatic decline from earlier levels. The dwindling burn rate raises fundamental questions about the asset's scarcity model as its circulating supply remains stagnant at nearly 60 billion tokens.

Price action reflects these concerns, with XRP trapped in a downward channel and testing critical support at $2.99. Unlike Ethereum's EIP-1559 or Shiba Inu's active burn campaigns, XRP's passive burn mechanism appears increasingly irrelevant to its economic model.

Ripple Labs faces mounting pressure to expand utility beyond transactional burns. Market participants now question whether XRP can maintain valuation momentum without meaningful supply constraints or new use cases.

Ex-Ripple Executive Outlines XRP's Institutional Focus Over Retail Trading

Dilip Rao, former Ripple executive, has clarified that XRP's primary utility lies in institutional adoption rather than retail speculation. The digital asset is designed as a bridge currency for high-volume cross-border transactions, with financial institutions driving its liquidity and usage.

Recent data shows institutional investors dominated XRP sales last quarter, reinforcing Ripple's strategic pivot away from short-term traders. "We're pursuing XRP as a financial asset for sophisticated institutions," Rao stated during a panel at the Global Islamic Economy Summit, drawing a clear line between speculative trading and operational utility.

This institutional-first approach positions XRP uniquely among cryptocurrencies, with its value proposition tied to banking infrastructure rather than retail market sentiment. The emphasis on deep liquidity through professional investors could redefine XRP's role in global payments.

XRP Price Prediction: Divergence Between ETF Volume and Market Performance Raises Questions

XRP's unexpected price decline this week has confounded traders, particularly given the simultaneous surge in ETF volume. Market participants anticipated institutional demand would buoy the asset, but instead faced a 7% drop—the sharpest single-day retreat since May. Technical charts now show a breakdown below the 50-day moving average, with RSI hovering near oversold territory at 32.

The divergence highlights growing tension between institutional adoption and retail sentiment. While XRP ETFs saw $280 million in inflows this month, spot markets recorded net outflows across major exchanges. "ETF volume reflects long-term positioning," noted Ripple Labs' head of markets. "Retail traders are reacting to macro pressures—it's a tale of two time horizons."

Analysts point to concerning parallels with 2023's Q3 performance, when XRP underperformed BTC by 18% during similar ETF growth periods. The asset now risks testing critical support at $0.42, a level that held through April's market-wide correction.

XRP Ledger Surpasses 7 Million Active Accounts, Marking New Milestone

The XRP Ledger has achieved a significant milestone with over 7 million active accounts, reflecting robust growth in its ecosystem. According to XRPScan, an analytics platform for the XRP Ledger, the current count stands at 7,000,768 accounts—each holding at least one XRP to qualify as active.

Beyond account growth, the ledger has seen 14.2 million XRP permanently burned, while 35.3 billion XRP remain locked in escrow. This underscores the network's deflationary mechanics and structured token distribution.

The metric highlights adoption momentum, though 'active' status hinges solely on balance—not transaction volume. The milestone arrives as the broader crypto market watches layer-1 blockchains compete for developer and user traction.

Is XRP a good investment?

Based on current technical and fundamental analysis, XRP presents a mixed investment case. The cryptocurrency is trading near key technical levels with the price at $2.9809, slightly above the 20-day moving average of $2.9667. Technical indicators suggest consolidation with potential for movement in either direction.

| Metric | Value | Interpretation |

|---|---|---|

| Current Price | $2.9809 | Neutral |

| 20-Day MA | $2.9667 | Slightly Bullish |

| MACD | -0.1289 | Bearish |

| Bollinger Upper | $3.1644 | Resistance |

| Bollinger Lower | $2.7689 | Support |

Fundamentally, the growing active accounts (7 million+) and institutional focus are positive, while supply concerns and ETF performance divergence present challenges. As BTCC analyst Ava suggests, 'Investors should consider both the technical consolidation and fundamental crosscurrents. A break above $3.16 could signal upward momentum, while failure to hold $2.77 may indicate further downside.'